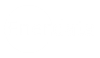

CO2 EMISSIONS ARE GOING DOWN IN THE EU27

Since 2015, emissions are down by 2%/year, driven more by the power sector (-6%/year) than final consumption (-1%/year).

The energy crisis has led to a significant loss in competitiveness for the European industry

Since 2022, industrial activity in the EU has dropped by 5% on average. This decline is steeper when accounting at more energy-intensive branches. These reductions are closely linked to the sharp rise in energy prices, which has hit the European industry hardest.

This fall in industrial production is the main reason behind recent drops in energy consumption and CO₂ emissions, much more than energy efficiency gains and decarbonization.

Electricity use in the industry has been decreasing since 2015, and its share in total industrial energy demand has grown only marginally. Despite decarbonisation goals, electrification in industry remains limited, especially in sectors where alternatives to fossil fuels are still costly or unavailable.

Energy efficiency and sufficiency behind the decline in CO2 emissions from households

Direct CO₂ emissions from households in the EU have fallen by 11% since 2019, despite continued moderate growth in population, dwellings, and equipment. This decoupling is largely due to improvements in energy efficiency, increased fuel switching, milder winters, but also energy sufficiency, i.e. a reduction in the consumption of energy services associated to consumer behaviour, independent from technical efficiency.

The share of electricity in households has increased only slightly—by 1.5 percentage points—since 2019, highlighting the slow pace of electrification in the residential sector. While heat pumps have emerged, now covering around 8% of residential space heating, their momentum appears to be slowing, with sales declining in 2024.

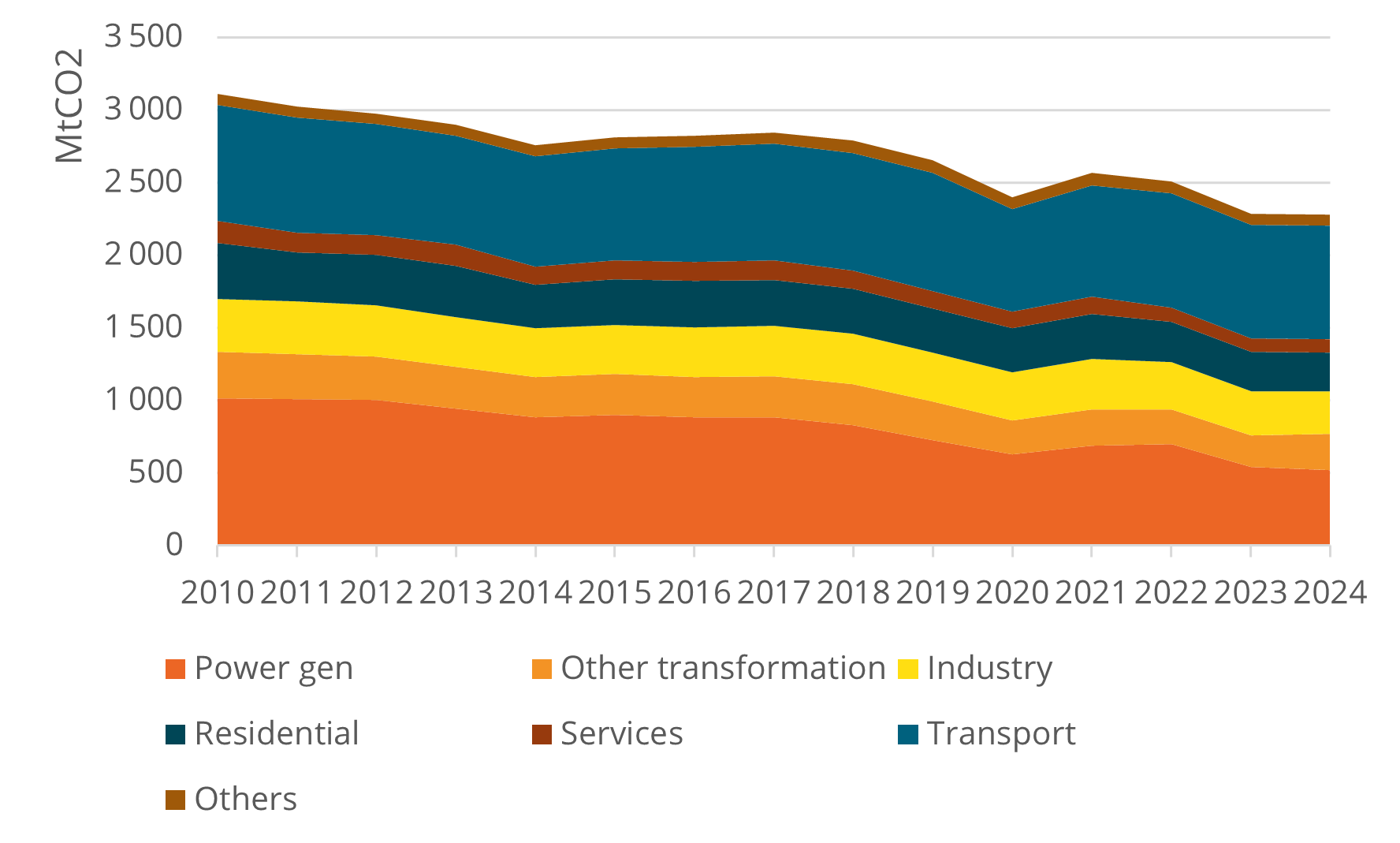

Stabilization of emissions in transport post-COVID, mostly because of traffic while EVs are not playing a significant role

CO₂ emissions from transport have been stable since 2022, around 4% lower than in 2019, before the COVID pandemic. This is mostly due to lower passenger traffic, while freight volumes have remained steady.

Electric vehicles still play a minor role, making up just 2% of the car fleet. New registrations have been increasing significantly but started declining in 2024 . This dynamic is also limited to private cars so far, thus limiting the reach of EVs. Electricity covers only 2% of the energy demand in transport as a whole, and this is still mostly due to rail, not road transport.

The energy mix has barely changed as oil products still account for 92% of transport energy use, and there have been no modal shifts towards low-carbon and less energy-intensive means of transportation: road transport dominates, with 90% of passenger and 80% of freight traffic, both stable since 2010.

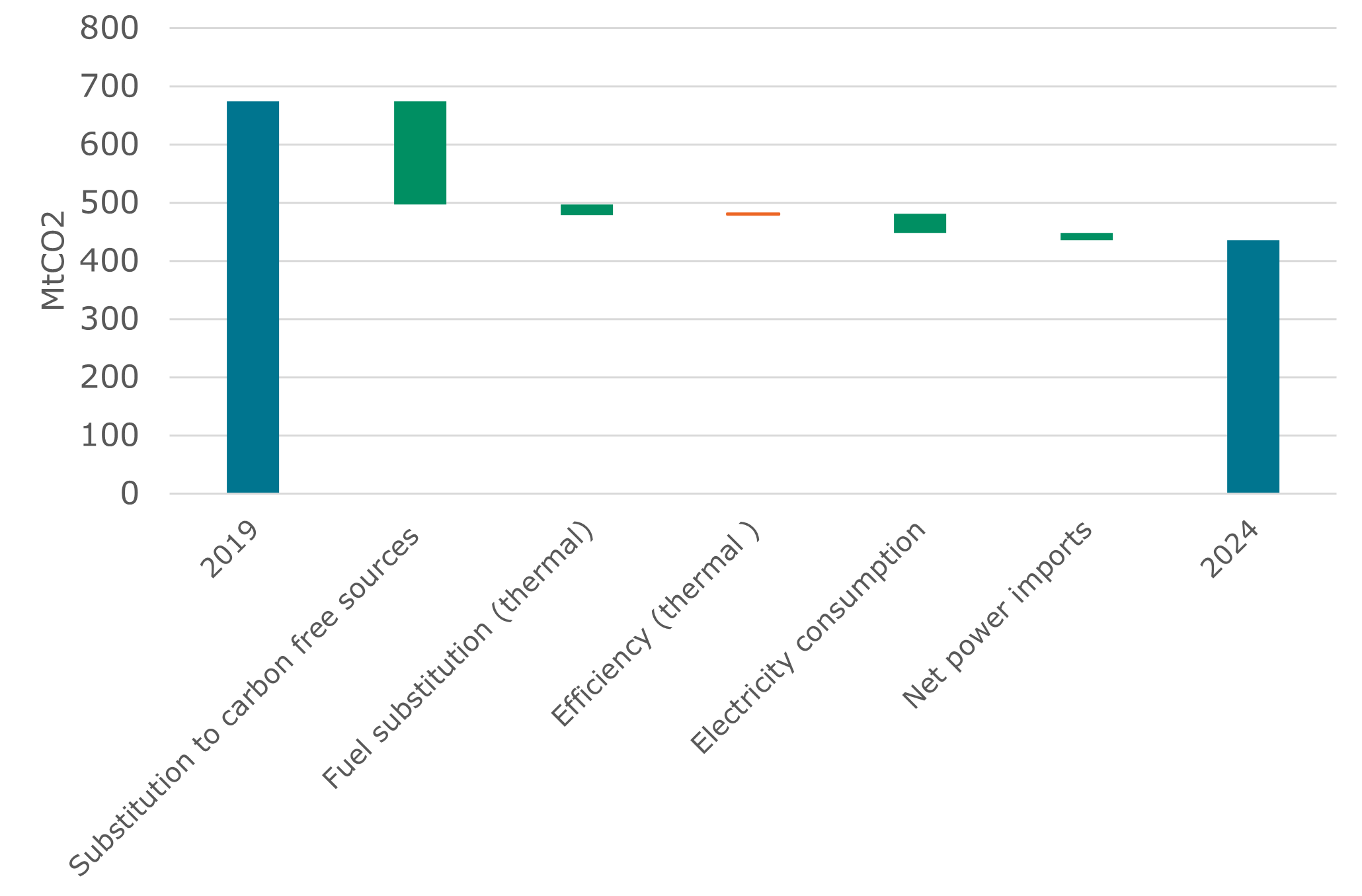

The EU power sector is on the right path with significant decarbonization

Renewables now account for nearly 50% of electricity generation, and they have been largely replacing fossil fuels. As a result, the carbon intensity of electricity has fallen by 40% between 2015 and 2024.

However, it should be noted that the drop in electricity consumption itself has also contributed to lower emissions. This is counter-intuitive to the notion that the decarbonisation of electricity generation must be accompanied by significant end-use electrification, to get the full benefits of cleaner electricity.

In sum, the recent decrease in emissions in the EU is due in large part to the economic and demographic context, which is not driving energy consumption and related emissions in the same manner as emerging economies. The decline in European industry as a major component behind the decrease in emissions makes it a concern rather than a positive outcome.

Low-emission and energy efficient technologies are emerging but not at a high-enough pace. EVs and heat pumps are niche applications and start to show signs of slowing down. The decarbonization of power generation through renewables has been significant, but the decrease in electricity consumption is such that the impact of renewable expansion has been limited.

Our 2025 edition of Global Energy Trends presents insights on essential energy data.

We have contextualised these findings against long-term climate targets :

- Which must accelerate their efforts to meet 2050 targets?

- What are the underlying drivers explaining why Europe is struggling to achieve the Paris Agreement objectives?

- Which regions are making substantial contributions to climate mitigation?

Access to the most comprehensive and up-to-date database on energy supply, demand, prices and GHG emissions (186 countries).

- Comprehensive

- Annual energy and GHG data from 1990 onwards

- Up to 2000+ data series and indicators by country per year

- Coverage of all energies in 186 countries

- Reliable

- 30-year experience in energy balances and statistics

- Data and indicators compliant with the best international norms